Week 18: Change of pace.

Sunsetting Venture Vantage, and welcoming No NDA Required.

Housekeeping

Welcome to our first week as No NDA Required. We’re here to fill the void that exists between emerging fund managers to de-gatekeep our ecosystem.

I felt that Venture Vantage wasn’t accomplishing my intended goal. It was a great entrance into the world of newsletter writing, but my audience felt unrelated to what I hoped to achieve in the venture ecosystem.

While founders are at the core of what we do, I really love talking to investors and helping them grow their funds. No NDA Required is exactly what it sounds like: a specialized, open forum to share information, events, lessons, perks, and more with our investor community. There’s nothing investors hate more than information behind an NDA, yet we’re quick to exclude others from so many facets of the emerging manager ecosystem. We want access to information, but are often the very ones to limit access.

What I hope to achieve with No NDA Required is a lot more aligned with what I hope to achieve with my personal brand: building an incredible network of mission-aligned investors who believe startups are the best vehicle for change.

People often talk about the challenge of “breaking into” venture, but no one talks about the challenge of “building up” venture. Starting a fund is incredibly challenging, and there are almost no resources to help fund managers. Hopefully, NNR will help provide some clear direction to learn from the mistakes of others.

My hope is that No NDA Required (NNR) isn’t just a newsletter, and that it really evolves into a community. Whether that community manifests as group dinners, a Slack channel, or a rotating circuit of coffee chats, I’ll be happy so long as we’re all meeting some really epic people along the way.

This isn’t just for emerging managers—it’s for anyone supporting an emerging manager, too. Whether you’re applying for your first VC role, or are anything from an intern to a fund admin, there will be plenty here for you.

I know not everyone will be happy about this change, but hopefully there’s still things in NNR you find valuable, even if you’re not working in VC.

I plan to avoid having the repetitive, templated format of VV, and instead have spontaneous and relevant information each week. Some weeks may be long, some weeks may be short, but it should always be valuable.

Thank you in advance for your continued support.

Diving right in and keeping things brief:

On my radar:

Ladies and gentlemen, DistilledIntelligence.com is live! Please check it out and let me know what you think.

Distilled Intelligence X account just went live here. Please give us a follow, it would be very much appreciated.

Apply to Distilled Intelligence here. Be sure to mention that NNR sent you!

Fundraising, fundraising, fundraising.

Had a great time in SF. Having a great time at Expo West. Meeting so many new people and reconnecting with old friends.

Meeting other emerging fund managers is currently top of mind.

Industry news

Moving forward, this section will be more focused on the prior week’s news. Think of this as one of the sections that is being brought over from VV. This time around, I’ll be getting caught up on some old news.

8VC goes unicorn

Context: 8VC just raised their Core Fund VI. It’s a $998M fund to invest in the “American frontier” and solve society’s biggest problems.

Vantage: This is another big step proving out my thesis that mid-sized funds are getting squeezed—the big “asset manager” like funds are eating them for lunch.

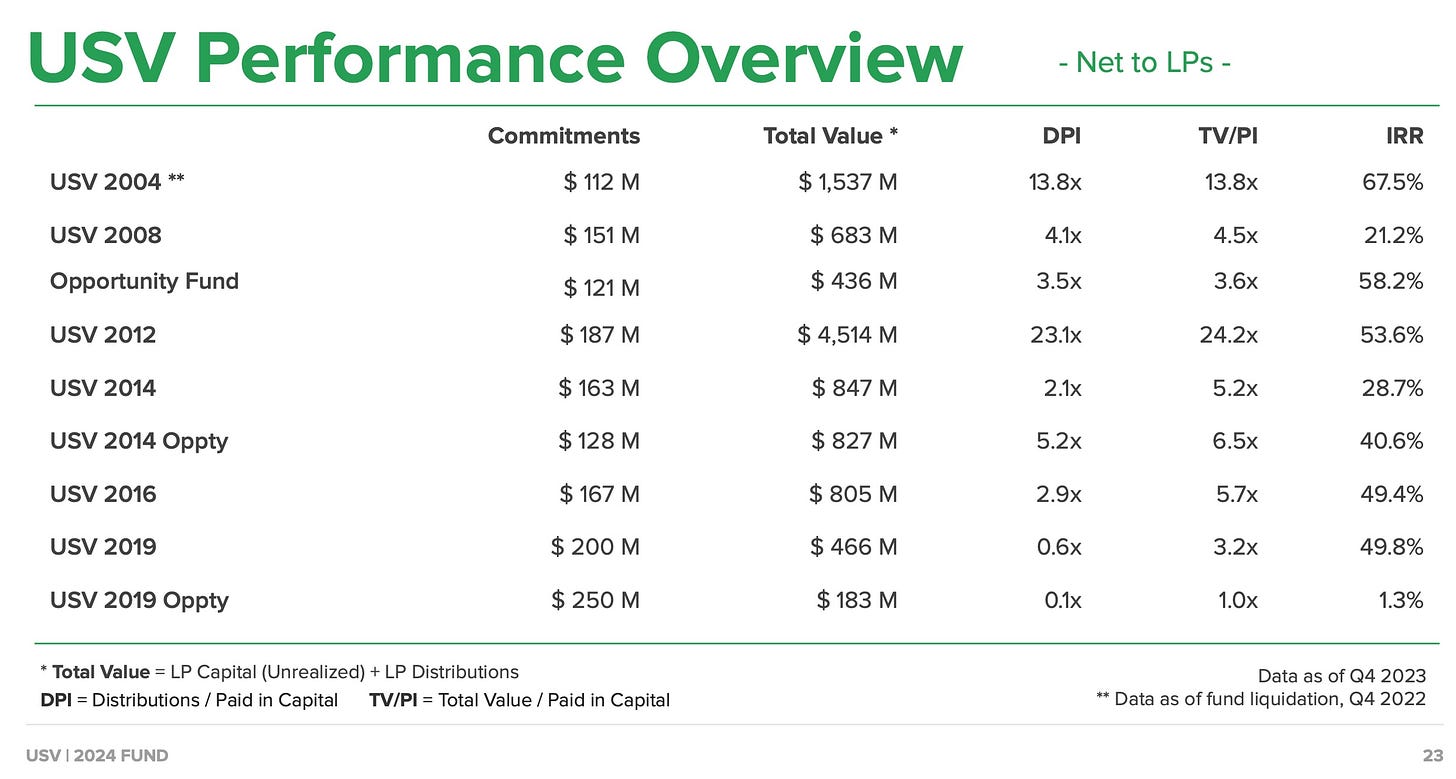

USV raised another fund

Context: USV just raised what they’re calling their 2024 Core Fund. I can’t imagine it’s any less than a $250M fund.

Vantage: Doubling down on what I said about mid-sized managers. USV is solidifying it’s place as a “big fund.” Interesting to see LPs still have an apetite to invest even with <1x DPI from the 2019 vintages.

Carried interest tax perks may come to an end

Context: Trump’s push to tax carried interest as ordinary income reignites debate, sparking industry fears of reduced investment and consolidation, squeeze smaller and emerging fund managers, and push the industry toward consolidation that benefits giant firms. Past efforts to close the carried interest “loophole” have flopped, but there’s a potential for this time to be different.

Vantage: Most fund managers ensure their portfolio companies qualify for QSBS but overlook that their own GP entity can too. By structuring the GP as a C-corp instead of an LLC and operating an active business beyond fund management, managers can position their equity for a tax-free exit after five years—just like startup founders. This can shield millions from capital gains tax in a GP sale, succession, or liquidity event. But it requires careful structuring to avoid the “investment company” designation, manage retained earnings, and stay QSBS-compliant. Talk to your fund admin about it!

Headlines

This is more general news, that I still think every fund manager should know!

Sweetgreen now has healthy waffles fries that are actually pretty good. Are they desperate for growth?

Saks Global has acquired Neiman Marcus Group for $2.7 billion. They hope to make the company super tech-forward to improve the customer experience.

Anytime there are consolidations of players at the top, we see an opportunity for a) upward growth and b) new players towards the bottom. I think the new “tech-enabled” play will make investing in fashion/luxury a lot more appetizing for venture investors. I have a thesis around micro-luxury experiences (democratization of luxury) and how personalized luxury will begin to gain even more momentum. Happy to share my thoughts there with anyone interested.

Late-stage funding is rebounding, up 70% quarter-over-quarter, while early-stage funding remains flat.

42% of all VC dollars in 2024 went into AI-related companies.

Early-stage funding for AI is massive – 74% of AI venture deals last year were seed or Series A.

Seed valuations hit an all-time high at $16M median pre-money in Q4 2024, showing strong competition for top startups.

Some LPs are opening up to new VCs again – 41% of institutional investors plan to add new venture fund managers in 2025. Public pensions like Maryland’s are still committing to emerging managers, with a $250M allocation over five years.

SpaceX is producing 15,000 new Starlink kits per day, a run rate of nearly 5.5 million annually.

Microsoft’s Dragon Copilot, an AI-powered clinical assistant built into Microsoft Cloud for Healthcare, combines voice dictation (DMO) and ambient AI (DAX) to simplify documentation, reduce administrative tasks, and improve clinician workflows, with general availability starting in May across the U.S., Canada, and parts of Europe.

Notion launched Notion Mail to compete with Superhuman.

Ashley Paston joined as a Partner at General Catalyst. She looks to be fairly young which is awesome, love to see it.

Deals that caught my eye

Renais Gin, the premium spirits brand co-founded by Emma Watson and her brother Alex, has raised $6.18M in a round led by InvestBev and Jean-Sebastien Robicquet of Maison Villevert. More celebrity alcohol/CPG!

Aescape just raised $83M, bringing its total to $128M. Led by Valor Equity Partners, with participation from Alumni Ventures and NBA star Kevin Love, the NYC-based startup is using robotics and AI to deliver personalized, automated massages for recovery and wellness.

Safe Superintelligence, founded by former OpenAI chief scientist Ilya Sutskever, is in talks to raise $1 billion at a $20 billion valuation, with Greenoaks Capital Partners leading the deal. This would mark a sharp increase from its previous $5 billion valuation, despite the company not yet releasing a product.

Ramp has secured a $150 million secondary sale at a $13 billion valuation, marking a strong rebound from its 2023 down round at $5.8 billion, with Khosla Ventures, Thrive Capital, and General Catalyst buying shares. The deal reflects growing investor appetite for high-growth fintech startups, while Ramp focuses on enterprise expansion, AI-driven automation, and maintaining low burn, with no immediate IPO plans.

Elon Musk’s AI startup, xAI, is in discussions to secure $10 billion in funding at a valuation of $75 billion, a significant jump from its previous $45 billion. Investors in the round include Sequoia, Andreessen Horowitz, and Valor Equity Partners.

Anthropic has secured $3.5 billion in funding at a $61.5 billion valuation, with Lightspeed Venture Partners leading the round. Investors include Salesforce, Cisco, and Fidelity, alongside existing backers Amazon and Google. They’re gonna hit $1B in ARR!

P1 Ventures closed a $50M fund to back African startups, focusing on underinvested regions beyond major tech hubs. Investors include African conglomerates, family offices, and the IFC.

GCM Grosvenor raised nearly $800M to support diverse and specialized emerging managers, offering seed capital and operational support to help them grow.

Helios, a provider of an AI-powered workforce management platform, raised $15.5M in Seed funding.

Camber Partners closed a TWO HUNDRED AND TEN MILLION DOLLAR FUND 2. I know, insane.

Bonfire Ventures closed out fund IV at $245M for B2B SaaS. Long LA, baby.

Greenfield Partners (based in Tel Aviv) closed $400M for Fund III, bringing AUM to $1B+ to invest in early growth enterprise tech.

Icing on the Cake:

Events I’ve come across

March 11 / Austin: SXSW Tech Mixer

March 13 / Austin: Founder/Investor Poker & Dinner

March 18 / NYC: AI Founder/Investor Dinner

March 18 / NYC: Brex Social Club

March 26 / NYC: Founder/Investor Poker

April 8 / NYC: Startup Fundraising Summit

How I can be helpful

Happy to talk through fund admin options with anyone. I spoke to 3+ dozen fund admins before hiring ours (Kranz Consulting). I can be a great sounding board and am happy to make intros to a variety of different fund admins.

Happy to introduce investors to other investors.

Happy to review pitch decks for founders. I can give a free, quick audit/feedback call and share my thoughts.

We see a ton of deal flow. Fill out Fortify’s deal sharing form to have the most relevant deals shared with you.

Some cool stuff on my radar

New iPad Air was just announced, with the new M3 chip. Great time to buy an iPad.

I bought more Moleskin pocket notebooks and am remembering why I love them so much.

Great deal on the automatic Speedmasters at Jomashop.

Closing

Thanks for taking time out of your Wednesday to read.

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli