Week 19: VCs are founders

Yes, I said what I said. Please don't have me killed by the Council of Founders.

Housekeeping

Welcome to another week of No NDA Required. We’re here to fill the void that exists between emerging fund managers.

I’m back on the East Coast, enjoying this surprisingly warm weather. SF two weeks ago, LA last week, NY this week, DC next week. My life is a sick, sick joke.

Fill out the form below if you’re in the startup ecosystem and would like to join the open-source community I’m building.

As always, please hit me back with feedback and comments—I’m constantly seeking ways to make this newsletter a more valuable read.

Diving right in and keeping things brief:

On my radar:

Apply to Distilled Intelligence here. Be sure to mention that NNR sent you!

If you’re an investor, shoot me an email here and we’ll get you on the ticket pre-order list.

Thinking of putting together an emerging fund manager/VC dinner sometime before summer starts… maybe one in LA and one in NYC? Shoot me an email here if you wanna come!

Coachella? Coachella. Coachella!

The main idea:

GPs are really founders and operators.

As a reminder, I am not an attorney, I am just a humble youngling trying to build a venture fund. Please, I beg, do not take anything I say as legal advice. That is what your overpriced attorney is for!

Starting a venture fund is incredibly challenging and expensive. The road is similar to that of an early-stage founder — the start is often bootstrapped, the failure rate is high, and a lot has to be given up to bring in early capital.

Structuring the GP is a complicated thing, but there are some tricks & important things I’ve learned to help with:

Understanding the entity structure of a fund.

Giving up GP as a common way to help bring in those first few LPs, giving them a bit of an economic advantage/incentive.

Making sure you’re following all regulatory & compliance requirements.

Understanding GP contributions, and how to allow others to make the GP contribution for you.

Staying tax advantageous.

Giving yourself some flexibility.

Entity Structure

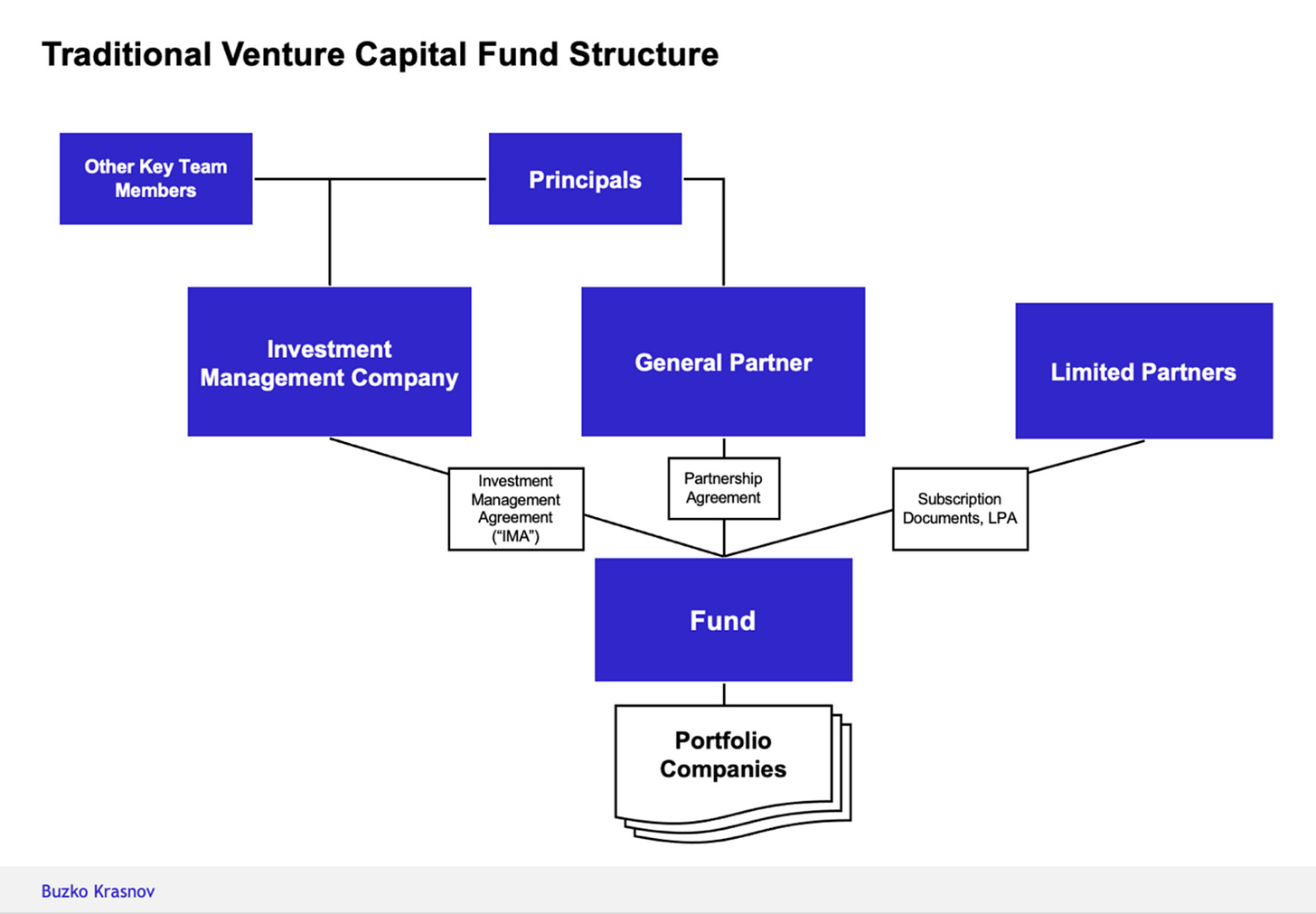

The entity structure of funds can vary, but most commonly, you’ll have 3 entities when starting a fund: your LP, your GP, and your Management Company.

Your LP is where investors put their money and what holds the assets (usually called X Ventures Fund I LP). The LP is managed by a Limited Partnership Agreement and assigns a general partner to manage the fund. The LP usually pays the big expenses of the fund, like attorneys, accounting, etc., so that it doesn’t come out of the ManCo’s 2% per year.

The GP is the entity that oversees the management of the fund and takes directive control of it. Most times, it is a separate entity from the Management Company. The GP (usually called X Ventures Fund I GP LLC) has its own GP agreement, owners, and makes a contribution to the LP (therefore becoming a limited partner). The GP is the one who signs on behalf of the LP, making decisions.

The Management Company is the actual Investment Adviser (that has to be registered, that receives the management fees, pays expenses, hires employees, etc.). The management company shouldn’t change as you raise more funds (usually called X Ventures LLC). When you buy coffee for a meeting with a founder, it comes out of the ManCo’s bank account, not the LP.

Sunset Provisions

Explicit sunset provisions to limit a special LP’s interest in the GP to only that specific fund. This is especially important if you do the silly thing of having the management company be the GP to the fund. If you do make the mistake of having the ManCo be the GP, make sure you create an agreement ahead of time with those special LPs to limit:

their right to management fees

how long they receive their GP interest (when it terminates)

their controlling rights with regards to investment decisions, management of the fund, influence over the hiring process, etc.

how much GP they have (is it a percentage of the actual LLC, is it just a cut of the carried interest, etc.).

It can also be important to limit the control power that LPs on the GP schedule have, whether through the management company or a dedicated GP LLC. Ideally, you want to give them economic interest in the GP, but not controlling interest. You can do this by creating different classes of shares in the GP.

Tax Strategy: QSBS

I think I mentioned last week that you might be able to have your GP entity be QSBS compliant by making it a c-corp… however, I take it back. To qualify for QSBS, you must devote 80% of your assets to “a qualified trade or business (most service-based businesses, finance, and real estate do not qualify).” So the GP would have to engage in some other kind of activity. If it engaged in some other activity, it could then cause problems for ERA exemption. Being a C-Corp would also probably trigger double taxation on distributions.

Long story short, it’s a shit idea and I eat my words. Sorry.

GP Stake

When you, or anyone, makes a GP contribution, they (usually) contribute the money to the GP. The GP then aggregates all the contributions, and puts up the GP stake as an aggregate check. What this means is that if you only make a GP contribution, you aren’t technically an LP; the GP is the LP.

This is where your GP agreement matters a lot — make sure you have clearly articulated how paybacks/distributions work within the GP. For example, Joe contributes $100k, Bob contributes $200k. There are 2 other people on the GP schedule. How do Joe and Bob get paid back before the 20% carried interest is distributed to the 2 non-contributing GPs? Do they all benefit from the upside/growth of Joe and Bob’s contribution?

Typically, GP stakes are 1-2% of the total fund size. Most often, anyone who is on the GP can qualify as their money being a part of the GP contribution.

LPs love a high GP stake because it aligns the GP’s incentives with LPs. But it also means personal exposure! If the fund underperforms, those who contributed to the GP stake may not recoup their investment. Ideally, it gives the fund managers a personal downside to poor performance, rather than just a personal upside to good performance.

There are GP Staking Firms, like Blackstone GP Stakes or Petershill Partners, all of which have different financial incentives to provide fund managers with GP contributions.

LPA and GPA

When starting a fund, the likelihood your year 1 (or even year 3) management fees will be enough to pay you a decent salary is relatively low. Unless you just sold your last company to Papa Bezos, you’ll probably need the cash to continue flowing.

A good thing to keep an eye out for is limiting/restricting clauses in your LPA or GPA. Yes, of course you want to promise your LPs that you’ll be managing their money to the best of your ability, and not only spending 3 hours a week on VC. Hopefully your GP stake will make them understand you’re aligned here. However, if you plan to do work on the side (it has to be non-competitive to the fund, not a conflict of interest, etc), it’s important to make sure that the LPA and GPA give you the flexibility to do that without forfeiting your interest to the benefits that come with being the GP or fund manager.

GP Sale

Sometimes, fund managers need cash before the fund sees any DPI. If the TVPI is good, and the likelihood of DPI is solid, it’s worth considering a GP Sale. The question becomes: does the LPA and/or GPA allow for it? If yes, then GPs can either sell the whole GP entity, or just their individual ownership, to someone else. Think of it like a secondaries sale where forward contracts exist.

We’ll continue this next week with talking about ERA and VCA exemption, and what it means for the fund managers!

Please don’t come after me with the “well actually there’s another way to do it!” for anything said above. I know, there’s a million ways to do everything I talked about here. I am just providing the “usual” or my favorite way to do things.

Headlines

Monica Lim left Eniac after 2 and a half years to join Microsoft’s M12 as an Investor. I don’t know Monica, but am stoked for her, even though I personally think the title of “Investor” is pretty bullshit (please see my LinkedIn for the irony).

TBPN is now 5 days a week. Real big boy shit. Keep it up, gents.

White House Crypto Summit was on Friday. Trump drove a Tesla today (or was it yesterday? Idk).

Waymo is expanding the service area that it’ll cover in the Bay, now giving rides to parts of the Peninsula. They’re starting with Palo Alto, Mountain View, and Los Altos.

Apple delayed the major Apple Intelligence features yet AGAIN. I’ve been hearing that they won’t be ready until AFTER the iPhone 17 launch. Someone remind me to open a massive short position on Apple, please. What startup will eat them for lunch?

According to The Info: Anthropic has reached $1.4 billion in annualized revenue as of this month, according to a person with direct knowledge of the company’s finances, implying monthly revenue of around $116 million. Holy shitsicles.

There are reports that OpenAI is planning to charge as much as $20,000 a month for high-end AI agents, while low-end agents might cost a tenth of that. And I thought the $200/mo option was a lot…

Apparently, Perplexity now has a marketing partnership with The Daily Wire’s The Ben Shapiro Show. Shapiro will use Perplexity to fact check a segment on his show, making for some pretty intense product placement.

Great video here Senofer Mendoza, of Mendoza Ventures, giving advice to emerging managers.

Deals that caught my eye

Big congrats to Lu Zhang (I hope you’re reading this, Lu!) at Fusion Fund for closing a $190M Fund VI! This is a huge milestone for Fusion Fund to continue investing in early-stage (pre-Series A) enterprise AI, healthcare, and industrial automation companies.

Flex, A Brex competitor that provides personal finance software and payments infrastructure for business owners, closed a $25M round at a $250M valuation. I wish I understood, but I don’t. I just don’t.

Foundation Capital raised a $600M Fund 11. Their fund numbers have fluctuated quite a bit, from $750M in 2008, to $282M in 2013, up to $500M in 2022, and now $600M. They still plan to remain hyperfocused on awesome early-stage founders.

NOCTAL raised $1.8M in a seed round led by Caruso Ventures. Logic tells me that Justin Caruso, son of Rick Caruso, is now running a venture fund/family office? Can anyone verify?

Rocket is buying Redfin for $2.4B. Redfin is actually a really interesting case study, HBS has one on them here.

Icing on the Cake:

Distilled Intelligence! Want to raise money? Come to Distilled Intelligence. Want to source great companies? Come to Distilled Intelligence. Want to help your portcos succeed? Tell them to come to Distilled Intelligence.

A couple events

Three events on my radar for after I come back to the city from DC:

Some cool stuff on my radar

The Cycplus AS2 Pro (my fav mini bike pump) is on sale right now on Amazon.

I actually got & have been wearing a PLAUD AI Pin. Absolutely love it, I can’t imagine in-person meetings without it. I just couldn’t wait for Granola to release their iOS app.

I’ve been taking Zest for the last few nights, and it’s pretty game changing. I find myself a little more tired by like 5-6pm, but the mornings feel great.

Been a big fan of my Magnanni Chelsea Boots. They’re the real deal — high quality leather and pretty comfortable.

Closing

Thanks for taking time out of your Wednesday to read.

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli