Week 26: Heat wave & LPs

Schvitzing my way back to the west coast.

Housekeeping

Welcome to another edition of 2&20. We’re here to fill the void that exists between emerging fund managers. As always, I’m here to help you grow the two things that matter: AUM and Alpha.

It was 104 degrees in NYC yesterday, and Mamdani won, which is my sign to get the hell out of here: Aug 1st I’ll be an Angeleno once again. I anticipate I’ll still do LA>SF>NYC>DC on repeat, just spending significantly more time in LA than the others.

Also, am I the only one who has been using hyphens instead of em dashes to prove that it’s me writing and not AI?

As always, please hit me back with feedback and comments—I’m constantly seeking ways to make this newsletter a more valuable read.

Diving right in and keeping things brief:

On my radar:

Samphire Neuroscience funding announcement has gone live! I realize I am yet to talk about it on 2&20… if you want to hear the story, read it here.

We’ve made our fourth investment, which we’ll announce in the coming weeks. They’re revolutionizing the intersection of health and future-of-work. If you want to learn more, I’ll be happy to share about it 1:1.

Investor tickets for Distilled Intelligence are officially up. You can check them out here! Use code STARTUP for a discount, we’d love to have you there.

I was in LA last week to set up my new office. There’s a great view of the Hollywood Sign from my desk, which is pretty epic. If you’re local, swing by and say hi once I’m back full time in Aug! I have 4 empty desks, so plenty of space for you to come co-work.

Have been having lots of coffee, meeting lots of cool people. Thank you to all the friends who have been making intros for me, helping me grow my network. Keep ‘em coming!

Please introduce me to your portco founders, we’d love to have them at Distilled Intelligence! Attendance is totally free for founders, hotel & food included.

The Main Idea

Lots of feedback in the last few weeks… thanks for the positive comments. The biggest suggestion was to keep things short, so I’ll do a better job of that this week.

The topic of this week is LP communication - covering how I personally tackle LP communication (specifically, materials provided) at each step of the fund cycle. Total commitments to first-time funds dropped to about $26.7 billion in the first three quarters of 2024, the lowest level in years. Nailing LP communication is more important than ever.

LP Types (context)

Brief context: the different kinds of LPs that are out there. This will be worth skipping over for most.

Institutional LPs are not investing their own money, and are full time LPs. They are more formal, and have higher reporting standards. It’s not your 75-year-old uncle who made some money… it’s a big organization who invests in funds all across the world. Examples include:

Pension funds

Endowments

Insurance companies

Fund of funds

Sovereign wealth funds

The opposite of an institutional LP is a retail LP. Retail doesn’t mean unqualified or amateur, it just means the person making the investment decision and the person is usually the same person who owns the capital.

High Net Worth Individuals

Family Offices

Institutional LPs usually have protocols or reporting requirements that they have to abide by, given that lots of them have some sort of fiduciary duty. They’ve been around the block, and know what to ask for. Audits, quarterly financials, robust data rooms, etc. They may ask for information in a standardized manner, so that they don’t have to sort or normalize data - makes it easy for them to compare performance across various investments.

The retail LPs usually want digestible, easy to understand reporting. Plain English, with more of an emphasis on portfolio construction.

Both, however, have an aversion to vanity metrics. According to PitchBook, ~64% of commitments to sub-$100M funds still come from individuals and family offices. So for the purposes of emerging fund managers, we’ll focus primarily on retail investors.

Information at different stages

To best explain how and what to communicate, I’ve broken it up into stages of the fund’s life. At each step, the expectations shift and evolve. It’s worth mentioning that there’s no one-size-fits-all. Your fund admin or attorney will be the most helpful in customizing the information presented here.

Pitching to LPs (pre-VDR)

The most important thing to start with is your grip on reality. They want to understand how you view the future of the world, given that your ability to predict future trends is what will guide how and where you build conviction.

According to VC Lab, successful GPs often need to engage 300+ potential LPs to secure around 50 actual commitments, roughly the minimum needed to close a small fund. The average Fund I size is currently sitting at $14.5M.

Before building our fund deck, I spent a ton of time developing our Playbook. I took inspiration from the Bloomberg Beta Operating Manual, a publicly available document that outlines how they plan to deploy cash, and what trends they have identified as having the highest potential for alpha generation.

Once you have a thesis & world view developed, a deck is the next step. Clearly articulating strategy, team, fund model, and track record is super important. Basically, you should have:

A long form explainer piece that provides a lot of context on why the fund even exists - what trends you believe are worth investing in, and how you see them as able to produce outsized, risk-weighted returns.

A send deck that is comprehensive, explaining:

Thesis

A fund summary (target size, number of checks, ownership target, etc.)

Differentiation

Track record

Team (experience, skills, etc.)

Unique deal sourcing engine

How you plan to win competitive deals

A simplified fund model

Service providers

A pitch deck that you can talk over, containing the same information as above, but with a lot less words. Expect to talk over the slides, rather than allowing the LPs to read through it.

A short memo, that looks almost like an investment memo. How should LPs underwrite this investment, and why is the risk worth the reward? Why are you the right fund manager (and asset manager) to be controlling their money? The bottom line here is, why should they trust you?

A lot of LPs will want a term sheet at this stage. We have an actual legal term sheet prepped by our attorney, as well as a summary term sheet I made. I basically took our full term sheet and turned it into plain English on a Notion page.

Optional, but what has been helpful for us, is a 90 second video of the GPs talking about the fund. People have short attention spans and hate reading… walk them through everything super quickly. It also gives them a chance to see your face and hear your voice.

Obviously, pitching these materials is crucial. Whether it’s in a warm intro, cold email, on a call, or following up from an IRL meeting, you should have templates that allow you to quickly send off this info to capture attention.

In 2024, 43% of emerging managers had to meet with 150 or more prospective LPs (up from 27% in 2023). 45% of managers said it took at least five meetings for an LP to finally commit (up from just 27% the year prior).

85% of emerging managers took more than 6 months to close their fund - and over half (52%) took more than a full year to reach a final close. 32% of surveyed emerging managers ended up reducing their target fund size.

Deep conversations (pre-commitment)

Once you’ve gotten past the initial pitch and have captured the LP’s attention, they’ll want to dig in deeper. This is basically the VDR stage, when they’ll want to really look under the hood. The more information you provide, the better, so long as it is all still relevant. Don’t just bury them in documents, but LPs also want to see that you have actually taken the time to flesh out your thesis and that what you’re saying is legit.

We are not shy to ask for an NDA at this stage. There’s tons of sensitive portco data in our VDR, and we want to make sure that LPs don’t go around telling other fund managers they have invested in who may have invested in competitive companies.

What I included in our data room is:

A walkthrough document that explains each piece of the data room, and helps them find an order to go through it. I have seen too many data dump VDRs that are impossible to navigate. No one can read your mind, so best to give them a guide.

A folder with past fund performance:

Past investor updates.

Audited DPI and MOIC numbers.

A summary of past funds’ portfolios.

Teams from past funds (helps LPs track changes over time).

News articles, pictures, founder testimonials, and other social proof.

Your introduction video.

Your fund deck.

Your Playbook and/or memo.

Your offering documents:

Term sheet.

LPA.

Subscription Agreement.

AML/KYC supplement.

Investor suitability questionnaire.

GP Agreement

ManCo operating agreement.

Incorporation docs for all relevant entities.

A folder for platform, showcasing how you interact with portfolio companies:

Testimonials from your current founders (in this portfolio).

A team folder:

Written bios for everyone on the team.

I included a 5-10 min video from everyone on the team talking about their background and work experience. Think of it like an intro in a job interview.

Links to our LinkedIns.

Calendar booking links so they can book time to have 1:1 conversations with everyone on the team.

References for folks on the team.

Info on investments for this fund:

Investment memos for each deal.

Closing documents, including side letters.

Diligence materials we collected from the company.

Summaries (if not already in the investment memos) on how we negotiated the deals, landed on a price, round dynamics, etc.

A financial folder that includes:

Sample reporting.

A comprehensive fund model.

Valuation policy.

Service provider information and contact info.

Fund admin, and the people working on your fund.

Attorney.

Accountants.

Other service providers.

Some folks include the ILPA Due Diligence Questionnaire. We do not, but worth considering if it is a fit for you.

Everyone will have different info to include. For us, it was about giving LPs as much information as they could reasonably digest, and that would actually be helpful in informing an investment decision. I wouldn’t be surprised if some people are outraged by what we did or did not share, and if people disagree with our necessity for an NDA at this stage.

Subscription process (post-commitment)

Once you get the yes, it’s easy to feel like you can take your foot off the gas and get comfortable. In the beginning of our fundraise, this is actually where we saw the biggest drop off/churn. Having a really clear cut process is what helped us improve that churn.

I made an “LP intake form” that collects all the data I need to send out sub docs. Entity type, phone number, address, email, etc. You’d be surprised how many people want their attorney to just take care of the sub docs, or they don’t realize that wiring from a trust is an issue after they just signed all the docs as an individual. Having this completed will hugely help prevent voided sub docs, AML/KYC issues, or having to chase down info when K1 time comes around. Ours is super short, this is the average response time on the TypeForm:

I ask for:

Name.

Email.

Phone number.

Address.

Investor type (individual, joint, entity, trust).

ERISA subject?

Investing entity name.

Investment amount.

Contact for anyone else they’d like CC’d on sub docs.

Once I have the above info, I send out sub docs using Flow. We love Flow, they have good pricing, and do a good job of both onboarding and investor portal. Happy to make an intro for anyone who’d like.

The really important/standout piece here is the onboarding instructions that took me forever to make. I have it as both a Notion room, and a Loom. We have 6 versions, customized to the different variations of the sub docs we send out. These instructions are super comprehensive… it literally explains each question, and shows the LPs how to navigate every step of Flow. Customized to our docs, and helps them avoid answering questions incorrectly.

Our fund admin will then go through and do the AML/KYC.

I will then verify accreditation (we’re a 506c fund) using our Investor Verification Protocol that I created a few months back. I can then keep direct line of communication with the LP if we are missing any docs to verify accreditation.

Collecting money (post-subscription)

Okay, now the LP has been admitted to the fund. AML/KYC and accreditation checks are done, and you’re ready to take their money. This is when I loop in our fund admin, although they usually are aware of a new LP by now given that they had to do the AML/KYC. The fund admin does what they have to on the backend (creating a capital account, etc.).

We allow our fund admin to reach out directly to the LP, but I am still fully in the loop at this point. A capital call will go out, and the LP will be required to fund. We like to send wiring instructions ourselves, because we’ve found that LPs get sketched out when they receive a capital call with wiring instructions from someone they’ve never met. I always offer to verify the wiring info over the phone.

Capital calls and initial docs all get uploaded/communicated via Flow. It helps us have accurate timestamps, and allows the LP to keep their contact information updated without having to tell us about the change.

Quarterly reporting (post-funding)

After the LP has made their first contribution and they’ve been admitted to the fund, it’s time to start sending the updates as required by your LPA. For some its audited financials, but for us, we do quarterly financials. We always try to provide within 30 days of the end of the quarter. Our quarterly reporting usually has:

Some market commentary and a letter from the managing partner. We provide highlights, and a high level overview of what we’ve been up to. This is usually called an MD&A (Management Discussion & Analysis).

A portfolio summary (valuation changes, new investments, exits).

Fund-level performance (TVPI, DPI, IRR).

NAV summary.

Capital account statements (per LP).

Material events (M&A, shutdowns, fund audits, etc.).

Fees and expense disclosure.

It’s so important to make sure that these updates are easy to understand, transparent, and consistent. This is where trust is built to increase the chances of the LP becoming a repeat investor in your next fund.

Other communication

Ad hoc reporting and other communication is just as important as everything above. It’s a balance to be helpful & informative, but not spammy. We try to provide our LPs with the option to receive commentary from us, like thoughts on news in the startup world.

Other important communication for us with our LPs include:

SPV opportunities that we have.

Regulatory notices.

New portfolio company announcements.

Portfolio company failure news.

Events (ranging from DI to other fun events we’ll be attending).

Round tables with some of our founders.

Asks on behalf of our portcos.

Abilities to get involved with the portfolio companies on the platform side.

LP meetings, or relevant notes from LPAC meetings.

We’ve learned that our retail LPs, especially the ones with smaller checks in the fund, LOVE getting involved and helping out. We’ve never had a negative response to asking them for help with a problem a portco is facing - they always jump on the opportunity to roll up their sleeves. We’ve also learned that our LPs love seeing deals we’ve passed on, but that they may want to invest in personally.

It’s also helpful to reflect back on your promises and vision. Go back to your Playbook and update it often… reflect on what you got right, and what you got wrong. What lessons have you learned that will make your next fund even more successful?

During the life of the current fund, work on creating a retrospective so you can drop it into your VDR of the next fund.

It feels silly to mention, but I’ve seen it happen way too often: be responsive to your LPs. The way I personally see it (this is not a view of the fund), founders are your customers, and LPs are your shareholders. I always reply to our LPs within 15 mins, even if it’s just “I’m super slammed today, will get you a comprehensive answer tomorrow.” They are the engine that enables your fund, so treat them with the highest level of respect, especially your early believers.

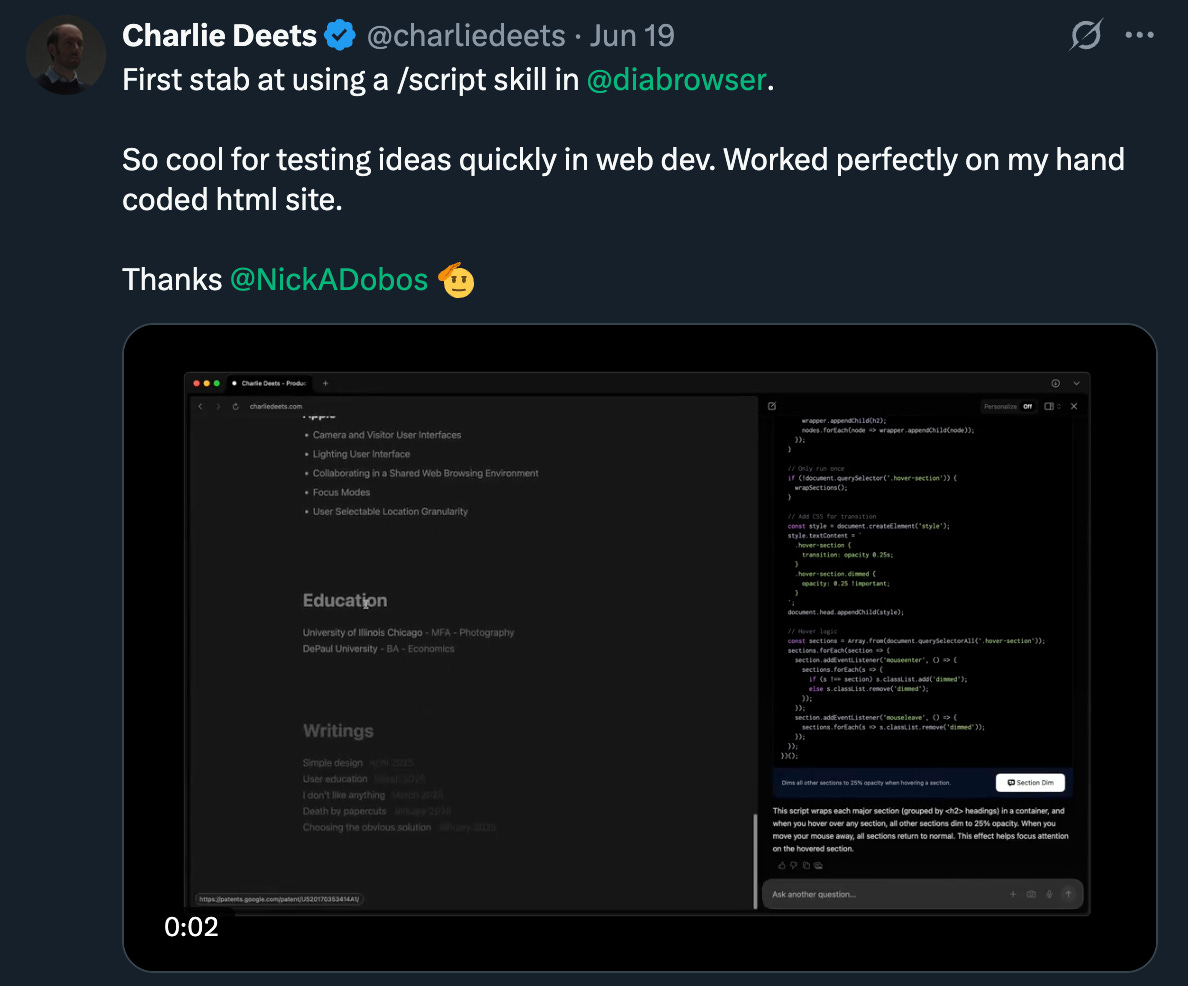

Dank Tweets

You can click any image below to see the original Tweet.

Some cool stuff on my radar

Here’s this week’s pocket dump. It’s been HOT in NYC:

AirPods Pro 2 (yes, I am double carrying)

Antibiotics

Sunbum Stick (UV 10 today, thnx)

They’re not quite as nice as the Sheldrakes, but I’ve had my eye on the Lemtosh from Moscot.

Jean Memory has been my favorite MCP the last few weeks.

Rimowa made an aluminum toolbox, so freakin cool.

I really want a TRMNL for my desk at the new office. Would be so handy, in addition to my 2 (will be 4) monitors.

Tennis in the Hamptons this summer? The Wilson x Kith is the only way to do it. You can also use it to play tennis at Distilled Intelligence.

Cool pullover from Spc/Lst, since it’s so cold out right now.

Osprey pouch is my daily driver… I have over a dozen of them. Cables in my backpack, wet clothes from the gym, everything.

Been very much enjoying my new Rockwell 6C razor.

Closing

Thanks for taking time out of your Wednesday to read. Since you made it this far, a little easter egg for you… Google the company on the shirt :)

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli

![TRMNL: The E-ink Companion For Your Favorite Tools [Sponsor] - MacStories TRMNL: The E-ink Companion For Your Favorite Tools [Sponsor] - MacStories](https://substackcdn.com/image/fetch/$s_!r3B5!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F24f44c02-6dc8-4bbb-b29a-1edfa8de0067_2048x1200.jpeg)