Week 29: Making the lawyers happy

Just comply, ok?

Housekeeping

Hey - Eli here.

Welcome to another edition of 2&20. We’re here to fill the void that exists between emerging fund managers. As always, I’m here to help you grow the two things that matter: AUM and Alpha.

Annyeonghaseyo! Greetings from Seoul. A peek behind the curtain of what it takes to write this newsletter:

As always, please hit me back with feedback and comments—I’m constantly seeking ways to make this newsletter a more valuable read.

Diving right in and keeping things brief:

On my radar:

We have been seeing some AWESOME deals lately. Fill out our deal sharing form to have relevant deals sent to you!

We’ve been full throttle on fundraising mode. Have an LP to introduce us to? I’ll buy you lunch.

I want to write an angel check into a cool CPG deal. Anyone know of anything? Pls share!

As a reminder, I am not an attorney, I am just a humble youngling trying to build a venture fund. Please, I beg, do not take anything I say as legal advice. That is what your overpriced attorney is for!

The Main Idea

This week we’re talking compliance… again! This time, we’re talking through policies and tracking for funds.

Everyone says “institutional LPs want institutional processes.” That doesn’t mean bigger logos or fancier decks. It means you can survive an audit tomorrow. My goal with this week is to help you do that.

Items to track

During the life of the fund, things will change: LPs will be added, money will be wired into the fund, investments will be made out of the fund, distributions will (G-d willing) be made to LPs, etc. Keeping things organized is the key to success - or rather, the lack of painful headaches.

LP tracking

Most LPAs require the GP to maintain a List of Partners. Usually LPAs just require that the name, address, and wiring instructions of LPs be maintained, but it would be silly to only keep track of that.

We use Flow to manage LP onboarding + communications, and it does a great job of collecting and retaining data. But what happens if you forget to make the payment for that year, or Flow goes down? You’ll find yourself SOL. To quote my prepper friends, “two is one and one is none,” so it helps to have a backup that you control directly. Here is how I made & maintain mine:

Track LP information

Address

Investment info

Accountant info/tax info

Contact info

Mailing address for holiday gifts

Wiring info

ERISA tracking

GP contribution tracking

Track money in + out

Subscription documents (store PDFs of:)

AML/KYC documents from fund admin

Signed subscription documents

Any LPAC documents

Any side letters

Now I’ve told you what I put in mine… so it’d be silly to make you build it from scratch. Here’s a gift for you:

Side letter tracking

Side letters are private agreements between you and specific LPs that give them customized terms. Most fund managers have no idea how much of a compliance risk they can be, though. Every special term you grant needs to be tracked. If you forget even one, you could unintentionally breach your own LPA. Uh oh!

Here’s what I recommend tracking:

LP name and signature date

Every clause in the agreement (fee break, reporting cadence, MFN eligibility, ESG or DEI reporting, co-invest rights)

Internal owner of each clause (fund admin, GP, counsel)

Status (pending, fulfilled, ongoing)

Proof of completion (a link to the document or email)

MFN window open and close dates

Expense and fee tracking

Even though your fund administrator tracks expenses, you are still responsible for what gets charged to the fund. The goal is to make sure fund money is only used for legitimate fund costs and that you can explain every charge later if needed.

Here are the columns I like to track in my Notion page:

Vendor name

Invoice date

Amount

My explanation of what the purchase was for

For example, “legal services for LPA and subscription documents” since sometimes the invoice doesn’t actually explain what the “product” was

Expense category (Fund or GP)

Expense type

I use labels like: legal, admin, tax, regulatory, fundraising, etc.

Approval and review

Our policy is that every invoice should be reviewed by one person and approved by another. I like to keep a record of who reviewed and who approved.

Payment date

Payment method

Notes, for things like offset or reimbursement

Once per quarter, reconcile your list with your fund admin’s ledger. Fix errors immediately and document what changed, ideally in the CYA folder that you have. Some banking systems (we use Rho) also allow you to tag/filter transactions, which can help you quickly find expenses on the backend, too! Highly recommend doing this.

Compliance tracking

By now, you probably get the idea. This is a list of what regulatory filings (Form D, ADV, Blue Sky, tax filings, etc.) have to be done, who drafted the filing, approved the filing, submitted the filing, paid the filing fee, when it was approved/received, confirmation number, all of that. Just helps you have a record of what was done, and by who.

Adopting policies for the fund

There are countless policies you can (and should probably) “adopt” for your fund. When our attorney first pressed us about this (it was before we had even started ideating the thesis of the fund) my immediate question was: why? Her answer was simply, “so I don’t have to become a defense attorney.”

All kidding aside, the policies you adopt for your fund serve not only to guide decision making and direction, but are also a crucial CYA for fund managers. The LPA gives you the “what.” Policies define the “how.”

We’ll dive into a few ideas and examples. Most fund admins have templates they can provide to you for free.

Valuation policy

The purpose of a valuation policy is to help the fund price the fair market value of its assets. If you remember, in Week 25 we covered NAV, or net asset value. NAV represents the total value of the fund’s holdings at a specific point in time. The valuation policy defines how that NAV is calculated, who approves it, and how frequently it is updated.

For early-stage funds, valuation is inherently uncertain. It all comes down to what you, or a third party are willing to pay - usually not based in revenues or tangible assets. Most assets are private and illiquid.

So here is what your valuation policy should include/instruct:

Frequency

Your fund admin should be driving here, with reminders before financial statements go out. It helps to look at valuations of your portfolio quarterly, with a formal review at year-end for audit.

Use quick check-ins between your main quarterly valuations for companies that have real changes in value. If a portfolio company raises a new round, struggles, or gets a follow-on investment, update that one position right away instead of waiting for the next full review. This is not a full revaluation of the fund. It is just a small update where something meaningful has changed. Record what happened (future round of funding, sunset, etc) and note the reason.

In your valuation policy, prescribe a frequency for each step, from you coming up with valuations to when you plan to review them with your fund admin.

Methodology

The easiest, most fair, and widely used method is the ASC 820 fair value hierarchy. It was created by the Financial Accounting Standards Board, and its goal is to standardize how organizations define and measure fair value.

ASC 820 defines “fair value” as the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date. It gives you a three-level hierarchy for the quality of valuation inputs. It ranks valuation inputs by how observable and reliable they are. It’s designed to make your valuation process transparent and reduce assumptions - so anyone reading your financials can see whether your numbers came from real market data or your own judgment.

Level 1: Based on quoted prices in active markets for identical assets.

Fact

An example of this is public securities that trade on an exchange, like shares trading on the NASDAQ. Each share is identical, so really easy to see the market price/comps.

Level 2: Based on observable inputs other than quoted market prices.

Reference

Think of it like one step removed from level 1. This includes prices for similar assets or recent transactions that are observable but not identical. For example, a private company that just raised a priced round led by a new institutional investor. The data is real but not public, and you may need to make adjustments.

Level 3: Unobservable inputs, based on your own models or assumptions.

Opinion

When there’s no market data available, you build a fair value using your own assumptions, like revenue multiples, comparables, or discounted cash flows. Early-stage VC investments almost always fall into Level 3.

When possible, you should try to use the highest level (level 1) of data available to you, and then make your way down if none of that data is available. Venture funds mainly live in Level 3 because private company data is limited and subjective.

When you value a company, your job is to find the most realistic price that a third party would pay today - not the highest one you can justify. The best valuations blend data with judgment. Start by looking for real transactions or observable data, then adjust based on what’s changed since that event. If there’s no new financing, think about progress: growth, customer wins, team expansion, or missed milestones. Your adjustments should always connect back to something tangible.

A good test is to imagine defending your number to an auditor or LP. Could you explain your reasoning in two sentences and show the data behind it/cite sources? If not, simplify the approach until you can. Fair value doesn’t mean optimistic or pessimistic; it means credible. The mark should make sense to anyone reading your report without needing you in the room to explain it.

For convertible notes or SAFEs, base fair value on the most recent preferred round and adjust for conversion terms.

In your valuation policy, create a clear framework for a) what methodology you plan to use, and b) how you will actually go about applying that methodology, step by step.

Documentation

Prepare a one-page memo for each company, following a template. Include the last financing round, ownership percentage, method used, comparable metrics, and conclusion. Make sure you share access to these memos with your fund admin so they can reference them for NAV updates in quarterly statements, etc.

In your valuation policy, you should clearly describe what documentation will be used to record valuation changes. Who can create the memos? Do certain people need to sign off on the memo? Do the memos need to be readily accessible by every LP (check your LPA for that one)?

Typically from a governance standpoint, valuations should be prepared by the GP, reviewed by the administrator, and approved by the LPAC. So having a clear packet of documents is important.

Expense and fee allocation policy

The purpose of an expense and fee allocation policy is to make it clear what the fund pays, what the GP or ManCo pays, and how reviews and approvals work. I feel like this edition is getting long, so I’ll try to breeze through it.

So here is what your expense policy should include/instruct:

Categories

Fund pays: audit, tax prep, fund administration, formation and compliance filings, KYC, custodial or banking fees for the fund, deal legal tied to closing, portfolio insurance tied to the fund, SPV costs tied to fund-led investments.

GP or ManCo pays: fundraising and marketing, PR and website, general travel and meals, office rent and software for the team, conference sponsorships that are not tied to a specific deal.

Shared items: portfolio tools, founder events, research services. Define a fixed split or formula and record it with each invoice.

Broken deals

Define when the fund absorbs diligence costs and when the GP or ManCo does. For example: fund pays once counsel is engaged for a live term sheet. GP or ManCo pays for scouting and preliminary work.

The boring stuff

For approvals: One person prepares. A second person approves. Set dollar thresholds for a second approval. List the roles by title.

In terms of frequency: Your fund admin should push a monthly expense listing. Review monthly. Reconcile to the general ledger quarterly. Fix errors quickly and note the correction.

For documentation: See above! I explain how I like to track it.

Governance: Prepared by the GP. Reviewed with the fund admin. Summary shared with LPAC each quarter if requested or mandated by your LPA.

This is getting long…

So here are some ideas on other policies you should adopt, let me know if you want me to share details with you on any of them 1:1:

AML/KYC procedure: how you’ll go about clearing AML/KYC for each LP. Usually whoever is doing your AML/KYC will have this they can provide to you.

Investor verification protocol: whether or not you’ll be using the new changes in 506(c), and how you’ll be verifying accreditation (I explain more here).

Capital call policy: when & how you’ll ask your LPs for money, how much time you’ll give them to wire, etc.

Side letter and MFN policy: turn negotiated terms into tasks with owners, dates, and proof. It prevents missed promises and MFN mistakes.

Compliance tracking policy:

Summary and concluding thoughts

When you set procedures, actually follow them. The only thing worse, in my opinion, than not setting procedures is willfully ignoring them after you’ve set them.

If you need recommendations of fund admins & attorneys that can help you with this, feel free to reach out. I have a roster of about 75 folks between the two categories, covering every price point and approach.

Hope this was helpful! I’m doing my best to try to provide new info on topics that most fund managers have already heard about :) if you found this helpful…

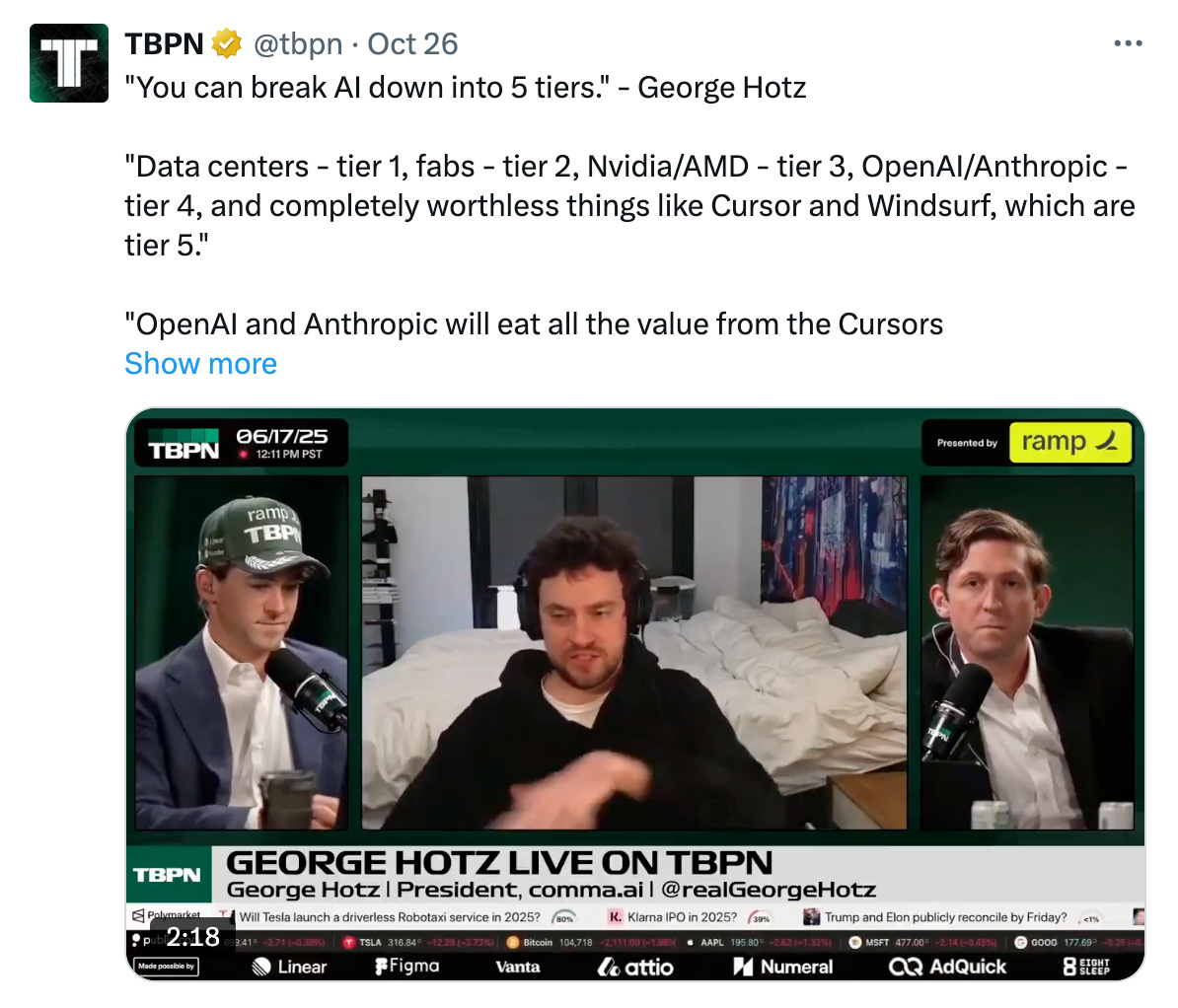

Dank Tweets

You can click any image below to see the original Tweet.

Some cool stuff on my radar

Now for my favorite part of 2&20… here’s this week’s pocket dump (from LA, not Korea):

All the AirPods (currently in the process of growing 6 more ears)

I’ve been using Fenn recently to search for files and it’s been great. Not quite yet a Finder replacement, but getting pretty damn close.

I know this seems ridiculous, but I recently switched from OneDrive to Dropbox. I must say, it’s somewhat lifechanging. To all the people who have been victims to my OneDrive file sharing, I apologize. I have seen the truth.

When living in NYC, I had to upgrade my jacket game. It sparked an appreciation for nice jackets. Now that I’m back in LA, I’ve been transitioning it to be more LA-friendly. My core jacket has now become the Arcteryx Atom SV. Pretty close to perfect.

Looking for an everyday watch? New Unimatic.

I’ve been traveling a lot lately and really enjoying my Aer Go Pack 2.

Have liked my Aer Street Sling Ultra as an EDC/CCW bag.

Interesting things I’ve read

Closing

Thanks for taking time out of your Wednesday to read. Since you made it this far, a little easter egg for you…

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli

Love this!