Week 25: Money

Or as the youth call it, "shmoney."

Housekeeping

Welcome yet another edition of 2&20. We’re here to fill the void that exists between emerging fund managers. As always, I’m here to help you grow the two things that matter: AUM and Alpha.

I think my time in NYC is nearing its end… I’m planning to make the switch back to the west coast in the next few months. Whether I end up in LA or SF is TBD, but the venture ecosystem in NYC is a bit too narrow for my liking. Plus, really would love to be spending more time on my bike & helping rebuild the Palisades.

We’ll be talking about money this week. Cash in, cash out, cash up, and cash rainin’ down.

As always, please hit me back with feedback and comments—I’m constantly seeking ways to make this newsletter a more valuable read.

Diving right in and keeping things brief:

On my radar:

Fundraising is currently our biggest bottleneck. I think there’s this weird culture in VC where people like to pretend like they just snap their fingers and money appears… I’d like to be the one to talk about the struggles of raising a fund a bit more honestly.

DI has pivoted, and it’s now a general summit. Golf, tennis, run club, fun dinners, happy hours — think of it like adult summer camp for really interesting people building really cool shit. If you, or anyone in your network, would like to attend, please reach out.

NY Tech Week is definitely top of mind this week. Been having fun running around events and supporting friends, but man, it’s a really poor use of time. My schedule this week has been fun events from 9-5, and then work at the office from 5-10.

I want to meet more investors. Please, introduce me to your friends.

We had Somble 2.0 launch day

The Main Idea

Raising a fund is one thing. Running it is another. I think there’s a lack of transparency about how money actually flows through your fund, how it gets tracked, who pays for what, and how performance is measured. Most folks know that their fund admin will handle this, so they tend to not learn it.

I’m going to start a little basic here… please forgive me. I think it’ll be helpful for some of the analysts who are reading.

Capital Commitments, Capital Calls, and the Clock

A capital commitment is a signed promise from an LP to fund a specific amount over the course of your capital call schedule/period that you outlined in your LPA. A capital commitment is not the cash you have in your bank account, it’s what the LP has promised. If they default on this commitment, there are usually some pretty harsh penalties.

Some first time fund managers miss that you only get that money when you call it. While it’s a capital commitment it’s not real cash you control, but once you do a capital call, it becomes cash in the bank.

Each capital call triggers a clock. That capital is now “contributed” and starts affecting your performance. Specifically, it affects time-bound performance metrics, like IRR. Your MOIC and DPI don’t really care about timing.

Example: If an LP commits $2 million and you issue a 10% call, they wire $200,000. That $200K becomes part of their contributed capital. If you wait three months to deploy it, your IRR suffers, since the money has already been in your possession for 3 months, not earning anything. The gamification of this becomes that fund managers try to do everything possible to wait to call capital, and to not have any capital sitting idle in their bank account.

Procedurally, you send a formal capital call notice, usually drafted with your fund admin. It includes the total call amount, due date (usually 7 or 10 days), fund wire instructions, and a brief description of use (investment, expenses, reserves). Admins track this in a cap call ledger, which must reconcile with each LP’s capital account.

The balance becomes: call as close to deployment as possible, without risking delays. Over-calling capital early drags IRR. Under-calling slows deals.

Treasury Management

Capital that’s been called but not yet deployed should not sit in a checking account. You’re literally burning IRR.

Even if it’s not a 20% IRR yield, you want that money to be earning something to lessen the blow. Treasury accounts are usually the highest yield while still keeping cash accessible, liquid, and relatively low risk. My favorite product right now is from my friends at Rho. Happy to make an intro, just hit me up here!

Drawdown Lines: Credit Instead of Cash

On the other side of this, to bridge gaps between capital calls, many GPs use a drawdown line, a short-term credit facility backed by uncalled LP commitments. It lets you wire an investment today and issue the capital call tomorrow.

For example… you need $1.5 million now for a fast-close round. Rather than calling LP capital, you borrow on the drawdown line. Then you issue a capital call for $1.5 million, use the incoming LP wires to repay the line, and keep your IRR cleaner.

Your bank (assuming they work with venture funds & have credit) underwrites the credit based on the quality of your LP base. If you’ve got a few endowments or big family offices, you’re more likely to qualify. The fund pays interest, usually a few hundred basis points over SOFR, plus standby fees. Wait… what are SOFR and standby fees??

SOFR (Secured Overnight Financing Rate)

SOFR is a benchmark interest rate. It reflects the cost of borrowing cash overnight in the U.S. Treasury market.

In practice, when you see a drawdown line offered at “SOFR + 300bps,” that means the fund pays whatever the current SOFR is, plus an additional 3.00 percent annual interest.

So if SOFR is 5.2%, your borrowing rate would be 8.2% annually. You’re only paying interest on the drawn amount, and only for the time it’s outstanding—so if you borrow $1M for 15 days, you’re only paying interest on those 15 days.

Standby Fee (aka Unused Commitment Fee)

This is a fee the bank charges you even when you’re not using the line. Think of it as a payment for keeping the facility available in case you need it. Rent for an empty office, basically.

Standby fees are usually around 25–50 basis points (bps) annually, applied to the undrawn portion of the credit line.

For example, if you have a $5M drawdown facility and never touch it, you might still owe $12,500 to $25,000 per year just to keep it open.

Capital Accounts

Each LP has a capital account. This is not a bank account, it’s a record of how much they’ve contributed, what it’s worth, what they’ve received, and how fees and carry affect them. Think of it like an accounting ledger.

A capital account includes:

Contributed Capital: What the LP has actually wired.

NAV: Their pro-rata share of what the fund currently holds.

Distributions: What they’ve received in cash or stock.

Carry Accruals: Their share of carry impact.

These accounts get updated quarterly by your admin and are used to calculate everything from DPI to final distribution waterfalls. Let’s say an LP has committed $2 million and you’ve called $500K. That $500K is their contributed capital. If you distribute $100K from an early exit, their DPI is now 0.2x. If the rest of their share of the fund’s value is marked at $600K, their TVPI is 1.4x. These numbers are calculated directly from their capital account.

All honesty, you could not pay me enough to manage and track Capital Accounts. Pure accounting that I want nothing to have to do with…

IRR, MOIC, DPI, and the other annoying acronyms

This literally took me one year to really learn and get clarity on. And the conclusion was… there is no real definition or procedure. I challenge you to find one, because you won’t. So, I’ll give you my definitions:

MOIC is what I am considering to be a “net” metric. You subtract all the bullshit. It’s, in my opinion, the best metric around how good a fund manager is. Total invested capital divided by total fund returns. It includes GP money in the numerator, but management fees are deducted. In the denominator, you take the pre-waterfall number. The reason I like this is because it shows what was actually done at the portfolio/fund level, and takes GP compensation out of the picture.

DPI is the number LPs like more, and for good reason. I consider it to be a “gross” metric… it is just looking at gross inputs and gross outputs. I contributed $1M, I got back $3M at the close of the fund, so 3x DPI. Simple, clean, easy. You literally just divide your total called capital by your total distributions, and on an LP basis ONLY. You leave GP money out of the equation.

IRR is time-sensitive. It’s a clusterfuck to try to calculate… there’s no equation I am going to give you, so just leave it up to your fund admin. But basically, if you return 3.0x MOIC over one year, your IRR might be above 150%. If that same return takes five years, your IRR drops to around 25%. MOIC tells you how much. IRR tells you how fast.

Gross IRR excludes fees and carry. Net IRR includes them. LPs really only care about the net.

Add NAV (the value of the fund’s holdings) to DPI and you get TVPI (total value to paid-in). That’s your full story: both what’s been realized and what’s still on paper.

Expenses (Fund vs. ManCo)

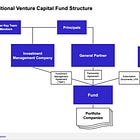

You have 3 entities (we covered this in Week 19 below).

The GP is more or less a pass-through entity from an accounting standpoint. Nothing really gets paid for by the GP. So it’s really just the ManCo and the Fund who are paying for things.

The ManCo gets paid 2% in management fees. In the average fund, only 40-60% of the management fees become salaries. The rest are spent on operations. If the management company had less in operations expenses, it could perhaps pay more in salaries! That’s where fund expenses come in…

When something is expensed to the Fund, it means the expense is taken out of the LP bank account, rather than it being taken out of the management company’s 2%. For this reason, GPs want to expense as much as humanly possible to the LP.

However, the Fund should really only pay for activities directly related to investing and the existence of the Fund. This is typically outlined pretty explicitly in the LPA. It includes:

Legal fees for transactions (although, it’s typically covered by the company)

Legal fees for the Fund

Diligence-related travel

Fund admin, audit, and tax prep

SEC filings, Blue Sky fees

There’s no hard and fast rule for what gets expensed to the Fund… it ends up being a little bit of a negotiation between GP and LP. Some GPs opt to cover travel and diligence costs, and instead pass Preqin or PitchBook costs onto the LPs.

Traditionally, though, the ManCo pays for:

Salaries

Fundraising travel

Office costs

LP marketing and events

Things like lunch, coffee, etc. when meeting with founders

Some LPs also require management fee offsets. If you earn board stipends or consulting income from a portfolio company, a portion of that must reduce the management fee charged to LPs.

Recycling

Recycling lets you reinvest returned principal into new deals without calling more capital. It’s capped in your LPA, usually at 110% to 120% of committed capital, and only applies to the original check, not the gain. Say you invest $1M, exit for $2M, and recycle the $1M into a new deal. That second company exits for $3M, and now you’ve generated $5M in distributions from just $1M of called capital. The gains still go back to LPs, but the principal gets a second life.

To do this, your LPA needs the right language, and you usually have to notify LPs in writing. Recycling boosts IRR and DPI without bloating fund size, but delays some cash returns and adds complexity to capital accounts and carry math. Still, if you’re in a fast-exit market or running concentrated bets, it’s one of the most powerful levers you’ve got.

Distribution Mechanics and Waterfalls

When a company exits, your fund admin runs the waterfall. The waterfall is the sequence of how cash gets distributed. First comes return of capital to LPs. After that, the remainder is divided, usually 80% to LPs and 20% to the GP. This is called the European waterfall, and from what I’ve seen, it’s the simpler and most typical way that it’s done.

In a European waterfall, LPs must receive all their capital back across the entire fund before the GP sees a dollar of carry. However, some funds employ a deal-by-deal waterfall. In deal-by-deal structures, carry is taken as each individual deal exits, even if the fund overall hasn’t returned full capital yet. Deal-by-deal tends to show up in PE or GP-led vehicles where the sponsor has meaningful skin in the game. It’s great when things go up and to the right. It’s clawback bait when they don’t.

If you mess up distributions or carry allocation, you’ll lose LP trust and potentially face clawbacks. Speaking of…

Clawbacks and Holdbacks

If you take carry early (say, after a big win), but the rest of the fund underperforms, you might owe some of it back. That’s a clawback. Most LPAs include this protection, with the GP personally liable.

To manage this, many funds hold back carry in escrow until final fund liquidation. It’s slower, but safer. If you’re raising Fund II while Fund I is still distributing, it’s often wise to over-reserve for clawback risk, even if it doesn’t look likely.

A fringe case

Okay, this is a bit of a fringe case, but I think it’s an interesting example of putting all of this into practice. I think it’s also a good example of how you can really take what we talk about here, and find some crazy niche situations to apply them to.

Let’s say you raise a $20M fund, call just $5M, and hit a massive early return. Can you stop there… skip the remaining $15M, return proceeds, and close the fund? Technically, yes. Capital commitments are contingent: LPs are only obligated to wire funds once you issue a capital call. If you never call it, they never fund it. DPI and IRR are calculated based on actual cash flows, not committed capital, so your 10x DPI on $5M contributed is real.

But here’s where it gets nuanced. Most LPAs give the GP discretion over timing and sizing of capital calls, but you still owe a duty of care and good faith. If you simply stop calling capital without formally terminating the investment period or dissolving the fund, you create a weird limbo state. LPs still have callable obligations on their balance sheet. Your administrator still has to report. The fund still exists.

To wrap cleanly, you’d need to (1) terminate the investment period, (2) formally cancel remaining capital commitments, and (3) begin the dissolution process as outlined in the LPA. This usually requires LPAC notification or consent, and final audited financials.

Strategically, a partial-deployment fund looks great on paper if the returns are huge, but it can complicate your story. Your “fund size” will get haircut to reflect actual dollars deployed. Some LPs may ask why their committed capital sat unused, especially if they passed on other managers to back you. And if you ever want to raise again, you better be able to explain why you left 75% of the fund on the table.

Dank Tweets

One of you asked for screenshots so you don’t have to click each link. Brilliant! You can click any image below to see the original Tweet.

Some cool stuff on my radar

Here’s this week’s pocket dump. It’s been rainy in NYC:

AirPods Pro 2 (yes, I am double carrying)

Prednisone

Have you seen the Rorra water filters? You should go buy one.

This house in LA is so nice…

I’ve seen these fancy tumblers all over my Instagram but am yet to try it.

I just copped a Suncraft Senzo paring knife, and it’s absolutely wicked. Highly recommend you check them out.

Ricoh just released the new GR4, right after I got one like two weeks ago. Nice.

Apple released CarPlay Ultra. Gonna go cop an Aston so I can try it.

ACL jacket is sick, although I don’t think it’s really needed for NYC summer.

Closing

Thanks for taking time out of your Wednesday to read. Since you made it this far, a little easter egg for you:

As always, you can find me on X and LinkedIn, and I’d love to hear from you via email. Whether it’s talking startups or just shooting the shit, I’m always happy to connect.

Onto the next!

//Eli